50% Off Corporate Tax Filing - Early Bird Discount valid till 31st August 2025

Satisfied Clients

Years Experience

On-time and Compliant

Expert Tax Consultants

At 10xM, our team comprises highly qualified Chartered Accountants and Tax Professionals, dedicated to providing comprehensive corporate tax services in UAE. We offer a range of solutions tailored to meet your business needs, ensuring seamless navigation through the corporate tax regime.

Our Services

Corporate Tax Assessment

Comprehensive review of business activities, financials, and operational structure to determine your tax obligations under the UAE Corporate Tax Law.

Strategic Tax Planning

Tailored tax-efficient strategies to reduce your corporate income tax burden, identifying exemptions, incentives, and relevant structuring opportunities.

Accurate Tax Return Preparation & Filing

Accurate preparation of Corporate Tax returns and audited financial statements, filed timely and in full compliance with FTA regulations, with simplified filing of Corporate Tax returns.

Tax Payment Support

Settlement of business tax dues through accurate calculations and end-to-end guidance on the payment process.

Audit Representation & Support

Navigate audits stress-free with expert representation, direct handling of authority communications, and full protection of your interests.

Ongoing Tax Advisory

Stay compliant and future-ready with ongoing updates, expert insights, and personalised corporate tax advisory services guidance as your business scales.

Why Expert-Led Filing Matters

Stay Compliant

A seasoned corporate tax consultant in dubai ensures your documentation aligns with UAE’s 7-year record-keeping laws.

Avoid Penalties

Experts help you avoid filing mistakes or misreporting in your corporate tax registration and ongoing filings that could trigger fines. Accuracy from the start means peace of mind.

Be Audit-Ready

With an expert managing your records and submissions, you’re prepared to handle FTA audits swiftly and stress-free.

Claim All Available Deductions

Consultants help track and document every eligible expense—from salaries to depreciation—so you don’t leave money on the table.

Missed the Corporate Tax Registration Deadline?

You might be eligible for late registration penalty waiver or refund

Find a Plan that's Right for You

Basic

AED 999

AED 499

For small businesses with revenue under AED 3 Mn

- Filing corporate tax return

- Free tax advisory (1 hour)

- Small business relief application

- Unlimited chat and email support

Standard

AED 1599

AED 799

For medium businesses with revenue from AED 3–10 Mn

- Corporate tax return preparation

- Corporate tax filing

- Free tax advisory (1 hour)

- Unlimited chat and email support

Super

AED 3599

AED 1799

For small businesses with revenue under AED 10 Mn

- Corporate tax return preparation

- Corporate tax filing

- Free tax advisory (1 hour)

- Unlimited chat and email support

Why Choose 10xM?

Local & International Tax Expertise

End-to-End Advisory & Compliance Support

Deep Understanding of UAE Corporate Tax Law

Proactive Risk Mitigation & Strategic Planning

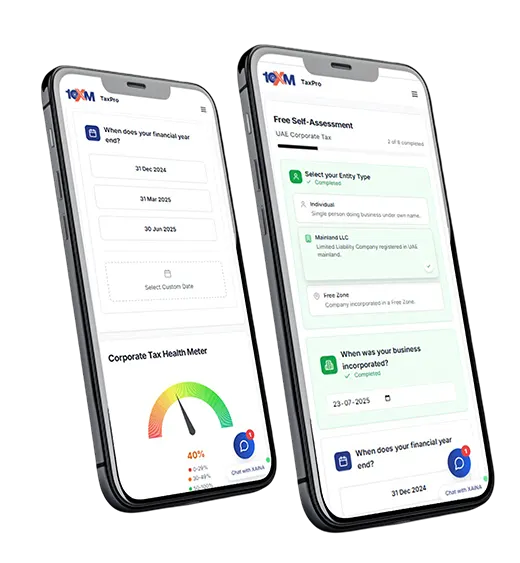

UAE's First

AI Tax Companion

Just chat, file and get your maximum

refund - guaranteed.

Partner with 10xM

Trust 10xM to streamline your corporate tax processes and governance framework, empowering your business to thrive in today’s ever-evolving corporate tax compliance landscape.

Founding Team

CA Manisha K

Managing Partner, Tax and Compliance

Swati Naidu

Managing Partner, Corporate Services

Trusted by Startups, Scaleups & CFOs alike

As a startup founder, navigating corporate tax felt overwhelming. We weren’t sure if we even qualified for Small Business Relief or what documents we needed. 10xM made it simple—not only did they confirm our eligibility, but they handled the entire filing process with zero stress.

We were scaling fast and had multiple revenue streams, and our internal records weren’t built for this level of tax scrutiny. 10xM cleaned up our documentation, that not only helped us file on time but also made us audit-ready. The peace of mind was worth every penny.

With multiple entities and cross-border transactions, we needed more than just a filing service—we needed strategic oversight. 10xM brought in both tax and structuring expertise, identified optimisations we’d missed, and made our UAE filings watertight.

FAQs

Yes, file your return by 31st July and claim penalty waiver or refund if already paid.

Yes, businesses with revenue over AED 50 million and all Free Zone entities claiming 0% tax must submit audited financial statements with their return. This includes those under free zone corporate tax UAE guidelines

Penalties apply for late registration, filing, or payment — including monthly fines and interest on unpaid tax. Timely compliance is crucial.

Small Business Relief allows eligible businesses to be treated as having no taxable income if their revenue does not exceed AED 3 million in a tax period. This applies until December 31, 2026 - ideal for small firms navigating business tax in Dubai.

To qualify, your business must:

a) Be a resident person (not part of a multinational group)

b) Have revenue not exceeding AED 3 million in the relevant and previous tax periods

c) Not be a Qualifying Free Zone Person

Yes, if their turnover exceeds AED 1 million (which triggers Corporate Tax registration) but remains below AED 3 million,

they may qualify for Small Business Relief.

If your revenue exceeds AED 3 million, Small Business Relief no longer applies, and you’ll be taxed at the standard

Corporate Tax rate (0% below AED 375,000, 9% thereafter).

© 2025 10xM. All Rights Reserved.